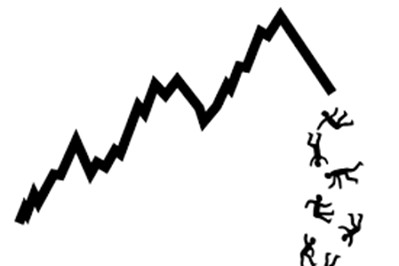

A blue-chip is a stock in a company with national fame. It operates well in bad and good times. It maintains its profit, reliability in any economic condition. The most popular index that follows blue chips is the Dow Jones. Usually, big multinational companies are part of Blue chip. Blue chips generally sell good quality, widely accepted products and services. Blue-chip stocks, also known as big-cap stocks, are based on the companies of high market values of $1 billion or more. Blue-Chip consists of deep-rooted, financially steady, and historically secure companies.

Why Investing In Blue Chip Stocks?

Nowadays, due to uncertainty in the financial market, blue chips are an excellent option. Blue chips are known for the strong executive team. They make smart choices and intelligent decisions, these decisions protect them from future economic failures. At the same time, they are maintaining quality. Famous examples of blue-chip stocks are Coca-Cola, Disney, Intel, and IBM. Blue-chip stocks are not cheap. But if you decide to invest in a blue-chip, profit is a sure return.

Here are a few of the top five blue-chip stocks you can invest before the recession.

1. Walmart

Walmart is one of the best blue-chip stock companies. Walmart can go through any depression without any trouble. The company recorded an increase in sales in the economic turmoil of 2008. Their sales increased to 7% in 2008. In the same year, the company also raised its bonus and shared returned– performing better than the S&P 500. Walmart is a leading company for 11 years. It has the highest revenue as compared to many companies.

2. Johnson & Johnson

Johnson & Johnson is another big company in blue-chip stocks. They do not have excellent products and fancy items. The sales growth of the company is also not very high. Yet, Johnson & Johnson is a trusted blue-chip stock for so many years. The company’s medical division provides support for health companies. Currently, Johnson & Johnson gives a 2.9% bonus.

3. AT&T

After many years of bad performance, AT&T’s shares are now on the rise. They are on the way to consistent and long term economic growth. The telecommunication and entertainment industry is a recession-proof industry. AT&T has managed to increase its exposure to the entertainment sector. Recently they have purchased Warner Brothers. They already own great networks like HBO, CNN, and the latest addition is Warner brothers.

Currently, it offers a 5.8% bonus to its shareholders. This high dividend amount is attracting new investors to AT&T.

4. Berkshire Hathaway

The company is progressing and improving for quite some time. However, the company shares remain the same for the last 20 years. It gives a chance to the investor to buy shares at a low price. Market experts believe that Berkshire’s earning is understated. The company has $100 billion of excess cash.

5. Caterpillar Inc

Caterpillar manufactures and sells construction equipment and engines for various locomotives and vehicles. Caterpillar has reported increased earnings of 0.9% in the last two months. Also, it’s expected growth rate for the current year is way above than the industries predicted gain.

Conclusion

The best time to buy blue-chip stocks is after the company revealed a disappointing earnings report or after a scandal. It lowers the company stock prices. You can purchase the shares at a lower cost and then sell them at a high rate later.